Bollinger Bands

What are Bollinger Bands?

Bollinger Bands are a volatility indicator that was developed by John Bollinger and is one of the most useful bands in technical analysis. Bollinger Bands consist of three lines – a simple moving average (SMA), and two lines calculated at a specified number of standard deviations above and below the SMA. The bands indicate overbought and oversold levels relative to the central SMA and can used to confirm trading signals.

Standard deviation is a statistical function that measure the probable variation from the average or the mean. One standard deviation above and below the mean theoretically contains 68.2% of the variations from the mean while two standard deviations above and below the mean contain 95.4% and three standard deviations above and below the mean contain 99.6% of the variations from the mean.

During periods of volatility i.e., during increased price fluctuation, the upper and lower bands widen and when the price fluctuations decrease, the bands contract and the Bollinger Bands narrows towards the central SMA. Bollinger Bands can thus be used to compare volatility and relative price levels over a period of time.

When the price action interacts with the upper band of the Bollinger Bands, the security is considered overbought, and when the price action interacts with the lower band, it is considered oversold. This signals possibilities to trade in the opposite direction once a trading signal has been confirmed.

How are Bollinger Bands calculated?

John Bollinger originally used a 20-period simple moving average (SMA) for the center band, a 20-period SMA plus 2 standard deviations for the upper band, and a 20-period SMA less 2 standard deviations for the lower band. Standard deviation is used in statistics and 2 standard deviations should contain 95.4% of the price action between the two outer bands.

Bollinger Bands uses a SMA for the central band rather than an exponential moving average (EMA) as simple averaging is used in statistics. Using a SMA, thus, ensures mathematical consistency in the calculation of the bands.

How are Bollinger Bands used?

Bollinger Bands are a popular indicator used in mean reversion trading systems. However, Bollinger Bands are secondary indicators as they do not provide absolute buy and sell signals when the price action reaches the upper or lower bands; instead, they indicate whether the price of the security is high or low relative to the price mean or the SMA. Bollinger Bands can also be used for a more informed confirmation of a trading signal when used in conjunction with other technical indicators.

Generally, contracting or narrowing bands indicate ranging market conditions. Under these conditions, a move that begins at one band normally carries through to the opposite band. However, contracting or narrowing bands often precede a possible sustained trend, though the first breakout is often a false move followed by a strong trend in the opposite direction. It is, therefore, advisable to use Bollinger Bands in conjunction with one or more non-correlated, oscillating indicators to confirm signals from the Bollinger Bands. This confirmation would be in the form of divergence.

Widening bands indicate an increase in volatility and the start of a trend. Under trending conditions, the price often "walks the band". In other words, in an uptrend the price tends to hug the upper band, and in a downtrend the price tends to hug the lower band. It is, therefore, important to use Bollinger Bands in conjunction with non-correlated indicators to confirm signals from the Bollinger Bands rather than just using the bands as indicators of overbought and oversold conditions.

The Bollinger Bounce

The Bollinger Bounce is a common trading strategy for Bollinger Bands, especially in ranging market conditions. The Bollinger Bounce is based on the principle that price action will tend to return to the median, or the central SMA in the case of the Bollinger Bands. A trader may place a buy order in the vicinity of the lower band or a sell order in the region of the upper band should the signal be confirmed by divergence on an oscillating indicator. A protective stop could be placed on the opposite side of the band, and an initial price target or exit would be at the central SMA and a final price target at the opposite band.

M-tops and W-bottoms

Another trading strategy for Bollinger Bands are the M-top and W-bottom reversals. The M-top is similar to a Double Top pattern when the price action makes two peaks. The first touches and closes beyond the upper band before the price declines but fails to reach the lower band before making a second peak. The second peak should not close outside the upper band. Negative divergence should be used to confirm the signal from the Bollinger Bands. A trader could then place a short order either at support level between the two peaks or at the central SMA, with a protective stop just outside the upper band.

The W-bottom is similar to a Double Bottom pattern when the price action makes two troughs. The first touches and closes below the lower band before the price climbs but fails to reach the upper band before making a second trough. The second trough should not close outside the lower band. Positive divergence should be used to confirm the signal from the Bollinger Bands. A trader could place a long order at the resistance level between the two troughs or at the central SMA, with a protective stop just outside the lower band.

Advantages and Disadvantages of the Bollinger Bands

Advantages

- Can be used effectively in non-trending market conditions.

- Provides a visual representation of price volatility. As the bands widen and narrow, the volatility increases and decreases.

- Indicates overbought and oversold conditions when the price is at the outer bands.

Disadvantages

- As a lagging indicator it follows price action, producing signals only after a price movement is underway.

- Prone to generating false signals and should be used in conjunction with other indicators to confirm signals.

- Not a standalone indicator.

Chart Example

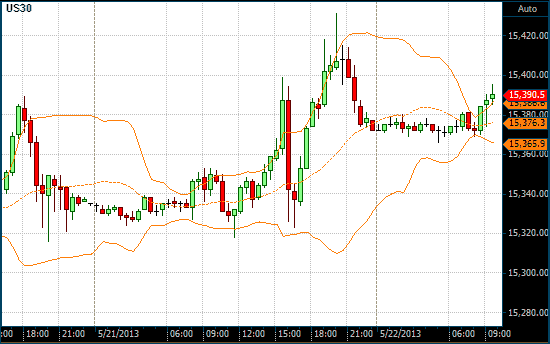

The following chart shows the standard Bollinger Bands in orange on a 30-minute chart of the Dow Jones Industrial Index. The middle (dash) line is a 20-period SMA. Notice how the bands contract during periods of low volatility and expand during periods of high volatility.

Bollinger Bands on a 30 Minute DOW chart