Average True Range (ATR)

What is the Average True Range?

The Average True Range (ATR) is a volatility indicator that was developed by John Welles Wilder and is used to measure the volatility or the degree of price movement of a security. It was introduced in Wilder's book, New Concepts in Technical Trading Systems of 1978 and was originally designed for commodity trading, which is frequently subject to gaps and limit moves. As a result, ATR takes into account gaps, limit moves, and small high-low ranges in determining the 'true' range of a commodity. Although the ATR was designed for commodity trading, it can also be used to for other securities, such as stocks and derivatives such as single stock futures (SSFs) and index futures.

The ATR indicator is based on absolute values in price rather than percentage change. Therefore a security with a higher price tends to have a higher ATR than a lower priced security.

How is the ATR calculated?

There are two steps in the calculation of the ATR indicator: first the true range (TR) of the security is determined; and then a Moving Average (MA) is used to smooth the ATR, but the moving average is not a moving average of the TR.

The TR is the greatest of the following:

- high – low

- abs( high – previous close )

- abs( low – previous close )

Once the TR is determined, we multiply the previous ATR by the averaging period less one, add it to the current ATR and divide it by the averaging period.

Thus, if using the default period of 14 the ATR would be calculated as follows:

ATR = ( ( Previous ATR x 13 ) + Current TR ) / 14

How is the ATR used?

ATR does not provide direction but is a strong indicator of a price break out as strong movements in the price of a security are often accompanied by large price ranges, especially at the beginning of a move. Thus, ATR can thus be used as an additional indicator to confirm a price break out. If the ATR is increasing, the support for a price breakout is also increasing.

ATR can also be used as a guide to determining stop loss levels as a security with a higher ATR will require a higher stop loss.

A popular use of the ATR is an exit method known as the Chandelier Exit that was developed by Chuck LeBeau and introduced in Alexander Elder's book Come Into My Trading Room in 2002. The chandelier exit is used as a trailing stop loss mechanism where a multiple of the ATR is subtracted from the highest high for the lookback period in an uptrend; and a multiple of the ATR is added to the lowest low for the lookback period in a downtrend.

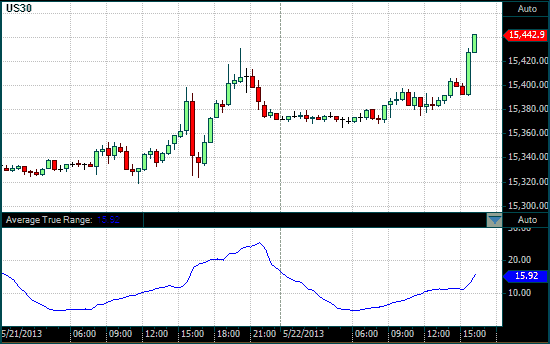

Chart Example

The following chart shows a 13-period ATR in the lower chart panel on a 30-minute chart of the Dow Jones Industrial Index.

ATR on a 30 Minute DOW chart