Stock Charts

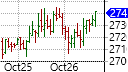

An OHLC Bar Chart

Stock charts are the foundation of technical analysis to the extent that technical analysts use charts almost exclusively. Stock charts provide a graphical representation that depicts price action and market data of the underlying security in a structured format. To the skilled chart reader, it provides an insight to the psychology of traders and balance of buying and selling pressure at that point in time and makes the recognition of trendlines and chart patterns possible.

Modern charting and trading software have made charting a far less cumbersome process of drawing price movements on graph paper, reducing it to a very simple practice that can be accomplished in a few clicks. This has allowed technical analysts to shift quickly between different time frames and to quickly apply a range of technical indicators to a price chart.

Types of Stock Charts

However, there are different types of charts that can be used in technical analysis. These include the popular bar charts, candlestick charts, and line charts, as well as the more recent point and figure charts, Kagi charts and Renko charts.

Candlestick charts, Kagi charts and Renko charts were all developed in Japan. They were introduced to the western world by Steve Nison, in his books, Japanese Candlestick Charting Techniques and Beyond Candlesticks: New Japanese Charting Techniques Revealed.

With the exception of the more recent Point and Figure charts, Kagi charts and Renko charts, which only plots a price change when a new high or low is made, all charts plot price action for a specific duration of time, which is called the time frame or periodicity, on a graph with the time on the horizontal axis and the price levels on the vertical axis. However, each of these types of chart plots price action differently, and displays different information about the price action in a given time frame.

Bar charts and candlestick charts are the most widely used price charts, followed by line charts. Point and Figure charts, Kagi charts and Renko charts are not as widely used as they do not plot price action over a given time frame or period. For this reason, indicators, such as oscillators and moving averages, as well as volume levels that are dependent on a fixed time frame cannot be applied to these types of charts.