Rate of Change (RoC)

What is the Rate of Change?

Rate of Change (RoC) is similar to the Momentum (MTM) oscillator as it is another simple leading momentum indicator that measures the pace at which a trend is accelerating or decelerating. The RoC does this by comparing the latest price close to a price close of a specified period in the past. Thus, a 7-day RoC compares the latest price close to the price close of seven days ago. Like the MTM indicator, the RoC tends to be erratic as it is very sensitive to price changes of both the latest close and the close of the specified period.

How is the RoC calculated?

RoC is calculated in two steps. First, momentum is calculated by subtracting the previous price close from the latest price close. Then the result is divided close by the previous price close and multiplied by 100 to give a percentage. The formula is:

RoC = ( Latest close - Previous close ) / ( Previous close ) x 100

where the previous close is an earlier price close specified by the trader. The result is a percentage that is plotted as an oscillator that oscillates between 100% and -100%.

How is the RoC used?

As with the momentum oscillator, the key consideration when using RoC is the center line. When the price of the underlying security is in an uptrend, a buy signal is generated when the RoC falls below its center line and starts to turn back up. When the price of the underlying security is in a downtrend, a sell signal is generated when the RoC moves above its center line and starts to turn back down.

In ranging markets (non-trending) the overbought and oversold reference lines are a key consideration. However, the reference lines must be drawn manually around the extreme areas of the RoC. As a general rule, the RoC should not spend more than 5% of the time above or below the reference lines. When the underlying security is in a range, a sell signal is generated when the RoC moves out of the overbought area over the upper reference line. Similarly, a buy signal is generated when the RoC moves out of the oversold area from below the lower reference line.

Entry signals are also generated when a trendline drawn on the RoC is violated.

Chart Example

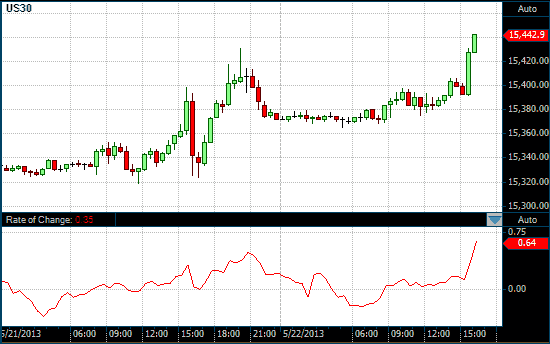

The following chart shows a 20-period RoC in the lower chart panel on a 30-minute chart of the Dow Jones Industrial Index.

RoC on a 30 Minute DOW chart