Average Directional Index (ADX)

What is the Average Directional Index?

The Average Directional Index (ADX) is a lagging trend indicator that indicates the strength of a trend. In other words, it measures when a security is in a strong uptrend or downtrend, or whether it is moving sideways in a trading range rather than a trend. It was designed by John Welles Wilder, Jr. as part of an indicator system that Wilder called the Directional Movement Index (DMI). The DMI, which was first revealed in Wells Wilder's book, New Concepts in Technical Trading Systems of 1978, consists of three lines: the +DI line, the -DI line and ADX line but the ADX can also be used on its own, and on any trading time frame, to help identify potential turning points on the price chart of the underlying security.

The ADX is an oscillator that fluctuates between 0 and 100, with values above 25 generally indicating a strong, sustainable trend and values below 20 indicating a weak trend or a flat trading range. However, the ADX is not concerned with the direction of the trend and does not indicate whether the trend is a bullish uptrend or a bearish downtrend. It merely indicates the strength of the current trend. For the ADX, a value above 25 can indicate a strong uptrend as well as a strong downtrend, in other words, a value above 25 indicates that a trend has been established, and is likely to continue. Extremely values (above 75) indicate overbought and oversold conditions that suggest the current trend would most likely be coming to an end very soon.

The ADX does not give entry or exit signals. It does, however, give some perspective as to whether the security is in a tradable trend, which can be quite useful to traders who implement, or plan to implement, tend-following trading strategies.

How is the ADX used?

Generally, stocks that are in a strong uptrend should be bought and held until one or more momentum indicators, such as the RSI or the CCI indicate a sign of weakness. Stocks that are in a trading range, i.e., moving sideways within a tight range should be analyzed using an oscillator indicator, such as the Stochastic Oscillator, or chart patterns for entry and exit signals.

When ADX is between 0 and 20 it indicates that the stock is in a trading range and is usually a sign of accumulation or distribution, especially when the ADX remains below 20 for more than 30 periods. Under these conditions, chart patterns are often easier to identify.

When ADX moves above 20 it indicates the beginning of a trend, though it could be an uptrend or a downtrend so remember to verify whether it is an uptrend or a downtrend before you commit to the trade.

When ADX moves above 30 it indicates the start of strong trend! This is the best time to enter a trade!

Once ADX moves above 50 it becomes more probable that the trend is coming to an end and trading ranges developing again.

Chart Example

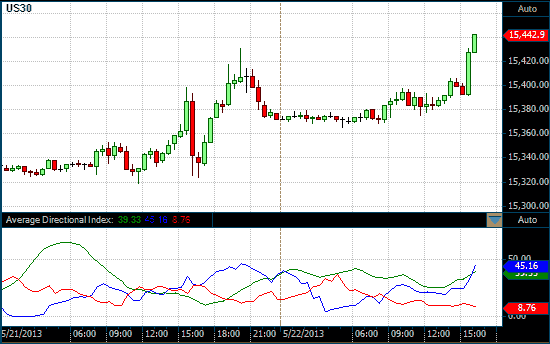

The following chart shows a 13-period Wilder's DMI in the lower chart panel on a 30-minute chart of the Dow Jones Industrial Index. The green line is the ADX line while the blue line is the +DI line and the red line is the -DI line.

ADX on a 30 Minute DOW chart