Corrective Waves

Corrective Waves are much harder to identify than impulse or motive waves and are much harder to label in real time. There is one important rule for corrections: they never form five waves. Only impulse waves form a five wave pattern. However, one or more of the subordinate waves of a corrective wave can consist of a five wave pattern, though this is not a rule as we will soon see when discussing the different types of corrections.

Guidelines for Corrective Waves

There are two guidelines that apply to corrective waves:

Alteration

The first is the guideline of alternation that states: if Wave 2 is a sharp correction, Wave 4 is likely to be a protracted, sideways correction; and if Wave 2 is a protracted, sideways correction, Wave 4 is likely to be sharp. More often than not, Wave 2 is a sharp correction and Wave 4 is a sideways correction.

Equality

The second is the guideline of equality that states: Wave A and Wave C tend to be more or less equal in length. This guideline can be used to determine where Wave C is likely to end.

Types of Corrections

There are a total of four basic wave patterns for corrections: zigzag corrections, flat corrections, triangles, and combination corrections.

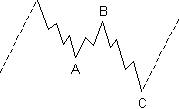

Zigzag Corrections

A Zigzag Correction

Zigzag corrections consist of a three wave pattern that is labeled A-B-C. The subordinate waves of a lesser degree that make up a zigzag correction form a 5-3-5 wave count. In these corrections, waves A and C are impulse waves and Wave B is a corrective wave of a lesser degree. A zigzag correction can extend to form double zigzags or triple zigzags with each zigzag being separated by an intervening wave that has three subordinate waves and is labeled X. You can often anticipate a double zigzag when Wave C of a zigzag appears to fall short of its normal target, though this is not a hard rule.

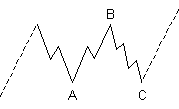

Flat Corrections

A Flat Correction

Flat corrections also consist of a three wave pattern that is labeled A-B-C but its subordinate waves form a 3-3-5 wave count. A characteristic of these corrections is that they are weak corrections with its Wave C often failing to exceed the length of Wave A. Flat corrections often follow a strong impulse wave and occur more often as the fourth rather than as a second wave of an impulse wave. Flat corrections have three subcategories: regular flat corrections; expanded flat corrections and running flat corrections.

Regular Flat Corrections

In a regular flat correction Wave B tends to be a 100% retracement of Wave A and Wave C tends to be slightly more than a 100% retracement of Wave B, ending slightly further than Wave A.

Expanded Flat Corrections

Expanded flat corrections have a megaphone shape with Wave B moving beyond the start of Wave A and Wave C moving beyond the start of Wave B.

Running Flat Corrections

Running flat corrections are very rare and are similar to expanded flat corrections with the exception that Wave C fails to move beyond the start of Wave B and also fails reach that end of Wave A.

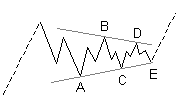

Triangle Corrections

A Triangle Correction

Triangle corrections consist of five waves labeled A-B-C-D-E with the subordinate waves forming a 3-3-3-3-3 wave pattern. They reflect a momentary balance of forces between bulls and bears. In an ideal triangle correction, each successive wave will fall short of a 100% retracement of the previous wave. However, it is not uncommon to have wave B exceed the start of Wave A. Sometimes an expanded triangle is formed when each successive wave is more than a 100% retracement of the previous wave. The triangle is formed by connecting the end point of waves A and C and the ends points of waves B and D. Triangles always occur as the fourth wave of an impulse wave and is usually followed by a short, swift fifth wave that travels the approximate distance of the widest part of the triangle.

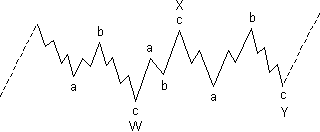

Combination Corrections

A Combination Correction consisting of a Zigzag,

an Intervening Three, and a Flat

Combination corrections are usually horizontal corrections that form combinations of simpler three wave corrections, such as zigzag corrections, flat corrections and triangle corrections. However, a combination correction can end in a triangle correction but it cannot start with one. Each of the simpler corrective patterns that make up a combination correction is separated by an intervening wave that has three subordinate waves as these are corrections in a correction. Combination corrections occur more often in the fourth wave.