Motive Waves

The price action in a motive waves move in the direction of the trend of the larger wave of one higher degree. In a larger motive wave, the subordinate waves 1, 3, and 5 are motive waves while in a in a corrective wave, subordinate waves A and C are also motive as they move in the direction of the larger wave. Motive waves tend to provide better trading opportunities as they are often easier to label than corrective waves. Motive waves are also often called impulse waves.

Motive Wave Characteristics

- Wave 1 is part of a basing process for the next move in the direction of the trend. It is often seen as a correction by those who have mistakenly seen the preceding A-B-C correction as the dominant trend.

- Wave 2 re-enforces the view that the preceding A-B-C correction was the dominant trend when it starts to retrace Wave 1. This explains why Wave 2 is often a sharp, deep retracement of Wave 1.

- Wave 3 is usually the most powerful wave as most participants in the market have now realized which trend is in progress. With more participants, Wave 3 often has the most momentum and travels much further than Wave 1.

- Wave 4 is a correction of Wave 3 that fails to overcome the euphoria that powered Wave 3 but it does drain most of the euporia in what is often a drawn out, shallow retracement. A Wave 4 retracement often lasts longer that Wave 2 although it retraces less than Wave 2.

- Wave 5 is the final push but does not have the same level of commitment as Wave 3. It thus lacks the momentum found in Wave 3 and may even fail to break the levels reached by Wave 3.

Elliott Wave Guidelines

There are several guidelines for motive waves that can aide in labeling a wave count. These guidelines include extension, truncation, channeling, and equality.

Waves Extensions

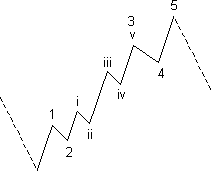

Wave 3 Extension

Motive waves generally consist of five subordinate waves labeled 1-2-3-4-5, but one of these subordinate waves can be extended to form an elongated impulse wave with exaggerated subordinate waves. Extension in one of the guidelines and is usually applied to Wave 3, though it can also be applied to Wave 5. The three rules provide an indication that a wave should be extended. If Wave 3 is the shortest wave, or Wave 4 overlaps the area of Wave 1, then Wave 3 needs to be extended. Extensions can simply be considered as counting another four waves as part of the impulse wave but instead of labeling them 1-2-3-4-5-6-7-8-9, waves 3, 4, 5, 6, and 7 are labeled as subordinate, or waves of a lesser degree. In this case it becomes 1-2-i-ii-iii-iv-v3-4-5 with Wave v (the Wave 5 of a lesser degree) being the end of Wave 3. It is also possible to extend Wave 5 if wave is not the shortest wave, and Wave 4 does not overlap with Wave 1. In this case, extending Wave 3 or Wave 5 would carry the same overall message. Furthermore, an extension can occur within an extension.

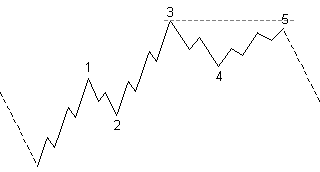

Truncation

Truncation of Wave 5

Generally, the subordinate impulse waves in a motive wave (waves 1, 3, and 5) will all be higher than the previous subordinate impulse wave with Wave 3 usually being the strongest wave. However, Wave 5 will sometimes fail to exceed the end of Wave 3. This is called truncation, and is another guideline. The truncated fifth wave must contain five subordinate waves or the wave count will not be valid. Truncation usually occurs after a particularly strong Wave 3 and indicates weakness in the preceding trend. It is also more common in highly leveraged markets, such as Forex markets and Commodity Futures.

Equality

Wave 1 and Wave 5 tend to exhibit a degree of equality in terms of distance. This is another guideline and helps indicate where Wave 5 is likely to end.

Channeling

It is possible to draw a trendline connecting the ends of Wave 1 and Wave 3. A channel can then be drawn parallel to the trendline with its base at the end Wave 2. This is the guideline of channeling and helps indicate where Wave 4 is likely to end.

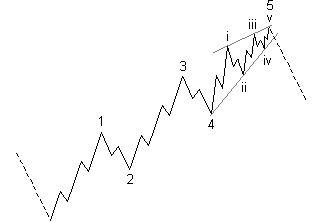

An Ending Diagonal

Diagonal Triangles

When is a motive wave not an impulse wave? When it is a diagonal triangle. This is a less common motive wave that also consists of five subordinate waves. In a diagonal triangle, it is also common for Wave 4 to overlap Wave 1. These diagonal triangles must be in the direction of the motive wave and cannot be corrective or reactionary. Therefore they have to take the shape of a wedge pattern rather than a triangle.

Ending Diagonals

Diagonal triangles occur more often in Wave 5 of an impulse or Wave C of a correction, where they indicate exhaustion of the larger movement and are called ending diagonals. The subordinate waves of an ending diagonal have a 3-3-3-3-3 wave pattern.

Leading Diagonals

On rare occasions a diagonal triangle may occur in Wave 1 of an impulse or in Wave A of a zigzag correction. Here they are called leading diagonals and their subordinate waves form a 5-3-5-3-5 wave pattern.

Motive Waves and Fibonacci Ratios

- Wave 2 is usually a deep retracement of Wave 1 and commonly retraces to the 61.8% or 78.6% Fibonacci retracement levels. At times Wave 2 may even retrace to the 100% retracement level but it may not exceed a 100% retracement. This is one of the immutable rules of Elliott Wave Theory: Wave 2 cannot be longer than Wave 1.

- Wave 3 is never the shortest of the three impulse waves, i.e. waves 1, 3, and 5. It is usually the longest of the three impulse waves and usually reaches the 161.8% or 261.8% Fibonacci projection levels of Wave 1.

- Wave 4 is usually a shallow retracement of Wave 3 and commonly retraces to the 38.2% Fibonacci retracement levels. Wave 4 may not overlap the price action of Wave 1. This is another of the immutable rules of Elliott Wave Theory.

- Wave 5 often travels the same length as Wave 1. It thus usually reaches the 100% Fibonacci projection levels of Wave 1. It also tends to reach the 61.8% Fibonacci projection levels of Wave 3.