Price Action

Price Action

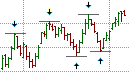

Welcome to our educational series of modules on Price Action. Price Action is a form of Technical Analysis that relies solely on price movement; it does not rely on fundamental news events; and it does not rely on mathematical formulas or indicators that often lag price action. Instead, Price Action only relies on price levels and how they relate to support and resistance, trendlines, and chart patterns.

However, trading Price Action, or Discretionary Trading as it's also known as, is quite subjective as it depends upon interpretation and one trader's interpretation will differ from another trader's interpretation. It is also quite difficult to back test Price Action. The key to discretionary trading is consistency as consistent actions result in consistent outcomes that are observable and measurable; though those outcomes may be positive or negative. Consistency will allow you to avoid actions that have been observed to lead to negative outcomes.

In this series of modules we will learn the basic principles of Price Action. Our focus will be on identifying market trends but we will start by taking a look at Market Structure. This is followed by an in depth look at Dow Theory as developed by Charles H. Dow who is widely regarded as the father of Technical Analysis in the western world. We will learn more about Trendlines and Trendline Analysis, including various Trendline Trading Strategies. Thereafter, we will look at Elliott Wave Theory where we will learn about Motive Waves and Corrective Waves, and Fibonacci Studies where we will learn about Fibonacci Retracements levels, Fibonacci Projections, and more.

Our Price Action series currently contains four modules: Market Structure, Trend Patterns, Elliott Wave Theory, and Fibonacci Studies.