Star and Star Patterns

Star Patterns

Having just completed the lesson on Triple Candlestick Patterns, let's look at special type of candlestick patterns, namely Star and Star Patterns.

What is a Star?

A Star is a single candlestick that is defined in relation to the candlestick that preceded it. A Star is a relatively small candlestick with a short real body that follows a relatively large candlestick with a large real body. The real body of the Star must gap away from the real body of the previous candlestick. These are the two defining characteristics of a Star:

- A small candlestick with a small real body that follows a large candlestick with a large real body.

- A gap between the real bodies of the small candlestick and the large candlestick that preceded it.

If the Star takes the form of a Doji, i.e., its close and open prices are almost the same giving it very little or no real body, it becomes a Doji Star.

The appearance of a Star in a strong trend is the first indication of weakness in that trend as it is in marked contrast to the previous candlestick which had a large real body. In other words, the Star indicates that trend is not as strong as it was on the previous candlestick as the market forces are now closer to equilibrium. This could be the beginning of a transition to a trend reversal in the opposite direction that could be confirmed by the candlestick that follows the Star. If this candlestick is a relatively large candlestick that moves against the current trend, then it and the two candlesticks that define the Star forms one of the Star Patterns.

Different Star Patterns

There are six patterns with a few slight variations that include Stars. These are: the Morning Star and Morning Doji Star patterns, the Evening Star and Evening Doji Star patterns, the Shooting Star pattern, the Tri-Star pattern, the Abandoned Baby pattern, and the Harami Cross. These patterns, with the exception of the Harami Cross, are triple candlestick patterns.

The Morning Star Patterns

If the Star form in a strong downtrend and gaps down from the real body of the previous candlestick, it becomes the Morning Star pattern, and if the Star in the Morning Star pattern is a Doji, it becomes the Morning Doji Star pattern. The Morning Star and Morning Doji Star patterns are strong bullish trend reversal patterns. To complete the Morning Star and the Morning Doji Star patterns, the candlestick that following the Star should be a large bullish candlestick that provides the confirmation of the reversal of the trend.

Further Reading

- The Morning Star Pattern in Candlestick Patterns

- The Doji Patterns in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

The Evening Star Pattern

The Evening Star pattern is the opposite of the Morning Star pattern. When the Star forms in a strong uptrend and gaps up from the real body of the previous candlestick, it becomes the Evening Star pattern, and if the Star in the Evening Star pattern is a Doji, it becomes the Evening Doji Star pattern. The Evening Star and Evening Doji Star patterns are strong bearish trend reversal patterns. To complete the Evening Star and the Evening Doji Star patterns, the candlestick that following the Star should be a large bearish candlestick that provides the confirmation of the reversal of the trend.

Further Reading

- The Evening Star Pattern in Candlestick Patterns

- The Doji Patterns in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

The Shooting Star Pattern

The Shooting Star pattern is similar to the Evening Star pattern in that it is a bearish trend reversal pattern. The difference lies in the shape of the Star. In the case of Shooting Star, the Star is an Inverted Umbrella Line. An inverted umbrella line is a candlestick with a short real body that is located at the lower end of the candlestick, leaving very little or no lower shadow, and a long upper shadow that is at least twice the length of the candlestick's real body. The last candlestick that completes the Shooting Star pattern is a large bearish candlestick that confirms the reversal of the trend.

Further Reading

- The Shooting Star Pattern in Candlestick Patterns

- Umbrella Lines in Reading Candlestick Charts

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

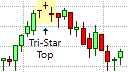

The Tri-Star Pattern

The Tri-Star pattern consists of three Doji candlesticks with the middle candlestick taking the form of a small Doji Star. The Doji Star must gap away from the previous Doji candlestick, with the following Doji then gapping away in the opposite direction to form the familiar Star Pattern. The Tri-Star pattern can be bullish, if it appears in a downtrend, or bearish, if it appears in an uptrend.

Further Reading

- The Tri-Star Pattern in Candlestick Patterns

- The Doji Patterns in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

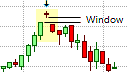

The Abandoned Baby Pattern

The Abandoned Baby pattern is a variation of the Morning Star or Evening Star patterns. The Abandoned Baby pattern differs from the other two patterns in that the Star in the Abandoned Baby pattern must gap away completely from the preceding candlestick, including the shadows of the previous candlestick, as well as the candlestick that follows the Star. If the Abandoned Baby pattern appears in a downtrend, it becomes a bullish Abandoned Baby Bottom pattern, and if it appears in an uptrend, it becomes a bearish Abandoned Baby Top pattern.

Further Reading

- The Abandoned Baby Pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

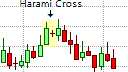

The Harami Cross Pattern

The Harami Cross pattern is a double candlestick pattern with the second candlestick in the pattern being a Doji Star that forms within the real body of the larger candlestick that preceded it. The Harami Cross pattern can be bullish, if it appears in a downtrend, or bearish, if it appears in an uptrend.

Further Reading

- The Harami Pattern in Candlestick Patterns

- The Doji Patterns in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns