Multiple Candlestick Patterns

Now that we've covered Star Patterns and Triple Candlestick Patterns, let's look at Multiple Candlestick Patterns that consists of more than three candlesticks.

What are Multiple Candlestick Patterns?

Multiple candlestick patterns are candlestick patterns that consist of more than three candlesticks. They can be classified as trend reversal patterns or as trend continuation patterns and they can be bullish or bearish. As with all other candlestick patterns, multiple candlestick patterns should only be taken into consideration if they appear in an exiting trend. If they form in a non-trending market, they can safely be ignored.

Common Multiple Candlestick Patterns

Candlestick patterns that consist of more than three candlesticks are much rarer than triple and double candlestick patterns. The following are some of the more common, though still rare, multiple candlestick patterns.

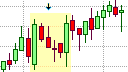

The Rising and Falling Three Methods patterns

The Three Methods candlestick pattern is a trend continuation pattern that is part of Sakata's Five Methods. It can appear in an uptrend or a down trend. In an uptrend it is called the Rising Three Methods pattern and, in a downtrend, it is called the Falling Three Methods pattern. Despite its name, the pattern usually consists of four or more candlesticks. The first and last candlesticks in this pattern must be relatively large candlesticks with large real bodies that are supportive of the current trend. These two candlesticks should preferably be Marubozu candlesticks with little or no upper and lower shadows. Between these two relatively large candlesticks are a series of smaller candlesticks that collectively move against the current trend without exceeding the range of the first candlestick. These could be two or more candlesticks, though three is the most common number for these candlesticks. The series of smaller candlesticks between the two large candlesticks represent a period of rest in the market. This is a natural phenomenon in a trend that has become a bit over saturated and in need of a rest before the trend can continue on its way.

Further Reading

- The Rising and Falling Three Methods Patterns in Candlestick Patterns

- The Trend Continuation Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

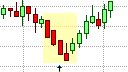

The Ladder Bottom pattern

The Ladder Bottom pattern is a bullish trend reversal pattern that warns of growing weakness in a downtrend and a possible transition to an uptrend. The first three candlesticks in the Ladder Bottom pattern take the same form of the candlesticks in the Three Black Crows pattern. Each of these three candlesticks are relatively long, bearish Marubozu candlesticks that close at or near the low price for that trading session and each making consecutively lower lows. These three candlesticks could have overlapping real bodies though this is not an absolute requirement. The fourth candlestick in the pattern is also a bearish candlestick but it has a short real body and a long upper shadow, which marks a weakening in the trend. This weakening in the trend is portrayed by its relatively long upper shadow and its relatively short real body. The fourth candlestick is the initial signal of a possible transition to an uptrend. This candlestick is followed by a bullish fifth candlestick that is light in color that opens above the real body of the fourth candlestick and closes higher. These last two candlesticks have increasingly bullish implications and hint at a possibility of a transition to an uptrend increases on the appearance of the fifth candlestick that is a bullish candlestick.

Further Reading

- The Ladder Bottom Pattern in Candlestick Patterns

- The Three Black Crows Pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

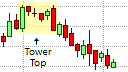

The Tower Top and Tower Bottom patterns

The Tower pattern is a trend reversal pattern that consists of at least four candlesticks. It is similar in appearance to the Advance Block pattern, the Deliberation or Stalled pattern, and the Ladder Bottom pattern that are all triple candlestick patterns. The Tower pattern, on the other hand, consists of at least four candlesticks of which the first is a relatively large candlestick with a large real body that is supportive of the current trend. This candlestick can be a Marubozu or it could have some upper or lower shadows. This candlestick is followed by a series of successively smaller candlestick that make successively smaller price gains or declines. The last candlestick is another large candlestick with a large real body but this candlestick closes against the trend. Here the two large outer candlesticks that are the towers have opposite colors.

Should the Tower pattern appear in an established uptrend, it becomes a Tower Top pattern, which is the bearish top reversal version of the pattern; and should it appear in an established downtrend, it becomes a Tower Bottom pattern, which is the bullish bottom reversal version of the pattern.

Further Reading

- The Tower Top and Tower Bottom Pattern in Candlestick Patterns

- The Advance Block Pattern in Candlestick Patterns

- The Deliberation or Stalled pattern in Candlestick Patterns

- The Ladder Bottom pattern

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

Other Multiple Candlestick Patterns

There are more multiple candlestick patterns that are even rarer. These are the Mat Hold pattern, and the Concealing Baby Swallow pattern.