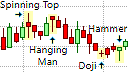

Single Candlestick Patterns

What are Single Candlestick Patterns?

Single Candlestick Patterns

Single candlestick patterns are classified as trend reversal patterns. There is no single candlestick pattern that is classified as a continuation pattern. However, single candlestick patterns often need to be read in the context of the candlesticks that preceded it, and often need confirmation. Being trend reversal patterns, single candlestick patterns must appear in an established trend. They should be ignored in non-trending markets where there is no trend that can reverse.

When single candlestick pattern has a short real body, the color of that real body is not important.

Single candlestick patterns can also form as part of other trend reversal candlestick patterns that consists of more than one candlestick.

Common Single Candlestick Patterns

The Doji

The Doji is a significant single candlestick patterns that can be either a bullish or a bearish trend reversal signal, depending on the nature of the trend that it appears in.

The Doji is a relatively short candlestick with no real body, or very little real body. It indicates that the opening and closing prices for the session were at the exact same level or very close together. The Doji can, however, have longer upper or lower shadows and has different names depending on the location of its real body, and the lengths of the upper and lower shadows.

- A Doji with a long upper shadow and a long lower shadow is called a Rickshaw Man or a Long-Legged Doji.

- A Doji with a long lower shadow and no upper shadow is called a Dragonfly Doji. It has greater significance in a downtrend as its long lower shadow has bullish implications.

- A Doji with a long upper shadow and no lower shadow is called a Gravestone Doji. It is the opposite of the Dragonfly Doji and has greater significance in an uptrend as its long upper shadow has bearish implications.

- A Doji with no upper and lower shadows is called a Four Price Doji as its Open, Close, High and Low are all the same price.

The Doji can form part of the Harami pattern, making it a Harami Cross; the Morning Star pattern, making it a Morning Doji Star; the Evening Star, making it an Evening Doji Star; and the Tri-Star pattern.

Further Reading

- Candlestick Charts in Stock Charts

- The Doji in Candlestick Patterns

- The Harami Cross in Candlestick Patterns

- The Morning Doji Star in Candlestick Patterns

- The Evening Doji Star in Candlestick Patterns

- Star patterns in Learn Candlestick Chart Analysis

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

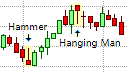

Hammer and Hanging Man

The Hammer and Hanging Man patterns have the exact same formation and are called umbrella lines. Umbrella lines are candlesticks with a short real body that is located at the top end of the candlestick. Consequently, they have no upper shadow or very little upper shadow but they do have long lower shadows that are at least two to three times longer than the length of the real body.

What distinguishes the Hammer pattern from the Hanging Man pattern is the nature of the trend in which they appear.

- When the umbrella line appears in a downtrend, it becomes a Hammer pattern, which is a bullish trend reversal signal.

- When the umbrella line appears in an uptrend, it becomes a Hanging Man pattern, which is a bearish trend reversal signal.

Remember that in candlestick charting, long lower shadows have bullish implications. The long lower shadow in the bearish Hanging Man pattern makes it a weaker reversal signal that would require confirmation. The bullish Hammer pattern does not require confirmation as it is a bullish reversal signal.

Further Reading

- Candlestick Charts in Stock Charts

- Umbrella Lines in Reading Candlestick Charts

- The Hammer pattern in Candlestick Patterns

- The Hanging Man pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

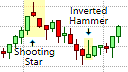

Inverted Hammer and Shooting Star

The Inverted Hammer and Shooting Star patterns are the opposite of the Hammer and Hanging Man patterns. They are also the same formation but are inverted umbrella lines. Inverted umbrella lines have their short real bodies located at the bottom end of the candlestick with a long upper shadow and no lower shadow or very little lower shadow.

The Inverted Hammer and Shooting Star patterns are also differentiated by the nature of the trend in which they appear.

- When the inverted umbrella line appears in a downtrend, it becomes an Inverted Hammer pattern, which is a bullish trend reversal signal.

- When the inverted umbrella line appears in an uptrend, it becomes a Shooting Star pattern, which is a bearish trend reversal signal.

Here the long upper shadows have bearish implications. Because of the long bearish upper shadow in the bullish Inverted Hammer pattern, more caution should be exercised when trading the Inverted Hammer.

Further Reading

- Candlestick Charts in Stock Charts

- Umbrella Lines in Reading Candlestick Charts

- The Inverted Hammer pattern in Candlestick Patterns

- The Shooting Star pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

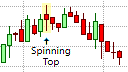

The Spinning Top

The Spinning Top pattern is similar in appearance to the Long-Legged Doji, except that it does have a real body. In other words, it is a candlestick with a relatively small real body and an upper and lower shadow that is longer than the length of its real body. The Spinning Top indicates a period of indecision in the market and can be bullish or bearish, depending on the nature of the trend in which it appears.

The Spinning Top can also form part of other trend reversal patterns, such as the Morning Star pattern, the Evening Star pattern, the Tweezer Top and Tweezer Bottom patterns, the Engulfing pattern, if it is the first candlestick that is engulfed by the real body of the candlestick that follows it, the Harami pattern, if it is the second candlestick that is enclosed within the real body of the previous candlestick, and the Homing Pigeon pattern.

Further Reading

- The Spinning Top pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trendlines in Chart Patterns

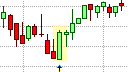

The Belt Hold Lines

The Belt Hold Line is a single candlestick pattern that nearly takes the form of a large Marubozu candlestick is only shaven at the end at which it opened. For this reason, it is called an Opening Bozu. The Belt Hold Line can be a bullish reversal pattern or a bearish reversal pattern, depending on the nature of the trend that it appears in. When it appears at a high-price level in an uptrend, it marks the potential end of that uptrend. Similarly at a low-price level in a downtrend, it marks the potential end of that downtrend.

The single Belt Hold Line candlestick opens by gaping away from the real body of the previous candlestick, in the direction of the prevailing trend. However, the candlestick then moves against the trend to close the window (gap) immediately and penetrates the real body of the previous candlestick before retracting a bit. When the candlestick eventually closes, it leaves a little shadow at that end, giving it the Opening Bozu form.

The Belt Hold Line can also form part of other trend reversal patterns, such as the Dark Cloud Cover pattern, or the Engulfing pattern, if it is the second candlestick that is engulfs the real body of the candlestick that preceded it.