The Dark Cloud Cover Candlestick Pattern

What is the Dark Cloud Cover Pattern?

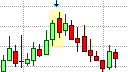

Dark Cloud Cover

The Dark Cloud Cover pattern is known in Japanese as kabuse, which means 'to get covered' or 'to hang over'. It is a double candlestick pattern that warns of a potential bearish trend reversal, making it a top reversal pattern that can appear in an established uptrend. It signals a potential weakness in the uptrend and is the antithesis of the bullish Piercing pattern, which is its bullish counterpart. As the Dark Cloud Cover pattern is a bearish trend reversal pattern, it can only be valid if it appears in an established uptrend.

The Dark Cloud Cover Formation

The first candlestick in the Dark Cloud Cover pattern must be supportive of the uptrend. In other words, it must be a bullish, light-colored candlestick with a large real body. The second candlestick should be a bearish, dark-colored candlestick. This candlestick must gap up at the open above the high of the first candlestick. In other words, it must open above the upper shadow of the previous candlestick. The gap up on open gives an initial indication of continued bullishness but the candlestick soon reverses and closes well into the real body of the first, light-colored candlestick and forms a "dark cloud" over the preceding up candlestick. The close of the second candlestick is also important as it must penetrate well into the real body of the preceding candlestick and must close beyond the mid-point of the previous candlestick.

What the Dark Cloud Cover Pattern tells us

The Dark Cloud Cover pattern signals a strong change in sentiment from bullishness to bearishness. During the fist candlestick in the pattern, the bulls are still in command. This continues into the second candlestick with the buyers pushing the price higher at the open to cause the gap up, however, the bears soon take over and push the price sharply down, causing a potential reversal. The subsequent candlestick could confirm the reversal to the downside. The Dark Cloud Cover pattern is more reliable if the second candlestick closes well below the middle of the real body of the first candlestick. The deeper the penetration of the second candlestick into the real body of the first candlestick, the more significant the reversal pattern becomes. It also becomes more significant if the two candlesticks that form the pattern are Marubozu candlesticks with no upper or lower shadows.

Trading the Dark Cloud Cover Pattern

The bearish Dark Cloud Cover pattern appears in am uptrend where it warns of weakness in the uptrend. This suggests that the bullish uptrend could be coming to an end. Traders with open long positions should, therefore, look for opportunities to exit their short positions and then prepare to go long. Traders would use the Dark Cloud Cover pattern to enter a short position on the close of the last candlestick in the pattern. A trader should always use a protective stop-loss order to preserve capital by limiting the risk of the pattern failing. An ideal location of a stop loss on this trade would be just above the high of the Dark Cloud Cover pattern as this can become a potential area of resistance. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented by the high of the Dark Cloud Cover. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The Dark Cloud Cover pattern does not provide a clear profit target, therefore other methods or candlestick patterns should be used to exit the short position. This could be a profit target based on a defined risk/reward ratio, a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most trend reversal patterns, the Dark Cloud Cover pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc. An Dark Cloud Cover pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the bearish Dark Cloud Cover pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the bearish Dark Cloud Cover pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.