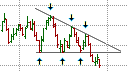

Descending Triangles

The Descending Triangle

The Descending Triangle pattern is similar to the symmetrical triangle except that its lower trendline forms a horizontal support line. Descending Triangles are bearish in nature and are most reliable when they appear as a continuation pattern in a downtrend. In these patterns, sellers slightly outnumber buyers. The market becomes oversold and prices start to climb. However, sellers then re-enters the market and prices are driven back down to the recent low, where buying occurs once more. Sellers re-enter the market, but at a lower level than before. The result is lower highs with a steady low. Prices eventually break through the support line where the lows were formed and are propelled even lower as selling increases along with an expansion in volume.

Entry Signal

An entry signal is given when the price breaks out of the Descending Triangle to the downside. This should occur about 66% into the triangle. If the price breakout occurs near the apex of the triangle, it is not valid entry signal as these breakouts tend to lack momentum and have a higher tendency to fail.

Price Projection

A price projection of the Descending Triangle can be calculated by taking the widest part of the triangle and subtracting it from the breakout point. Alternatively, a trendline can be drawn parallel to the support trendline which slopes downward, in the direction of the breakout, with the extension being the target price for the move.