Fibonacci Price Retracements

In our previous lesson, we discussed the Fibonacci sequence of numbers and the ratios that they produce. We have mentioned significance of the Golden Ratio, Phi, and it's inverse, phi. In this lesson we will start applying this sequence and these ratios to the trends that we have identified.

What is Fibonacci Price Retracements?

Fibonacci price retracements is a support and resistance indicator that is used to determine possible support and resistance levels. Like Fibonacci fans, Fibonacci Retracements levels based on the mathematical relationships, expressed as ratios, between the numbers in the Fibonacci sequence. In our previous lesson we mentioned that the Fibonacci sequence of numbers is simply the sum of the two preceding numbers starting with 0 and 1, and continues on to infinitely. Fibonacci price retracements are based on various mathematical operations performed on the numbers in the Fibonacci sequence, and on the results of those operations, expressed as a percentage.

- The first ratio of 61.8%, which is the inverse of "golden ratio" or the "golden mean" (i.e., the inverse of 1.61%), is found by dividing a number in the sequence by the number that follows it. These operations tend towards the golden ratio of 0.618 at the upper end of the sequence. For example: 34 ÷ 55 = 0.6182, 55 ÷ 89 = 0.6179 and 89 ÷ 144 = 0.6180.

- The second ratio of 38.2% ratio is found by dividing a number in the sequence by the number that appears two places after it. For example: 8 ÷ 21 = 0.3809, 21 ÷ 55 = 0.3818 and 55 ÷ 144 = 0.3819. It is also found by subtracting 0.618 from 1 (1 – 0.618 = 0.328) and by finding the square of 0.618 (0.618 x 0.618 = 0.382).

- The third ratio of 23.6% ratio is found by dividing a number in the sequence by the number that appears three places after it. For example: 8 ÷ 34 = 0.2352, 21 ÷ 89 = 0.2359 and 34 ÷ 144 = 0.2361. It is also found by subtracting 0.382 from 0.618 (0.618 – 0.382 = 0.236) and by multiplying ratio 0.382 by 0.618 (0.382 x 0.618 = 0.236).

- The fourth ratio of 78.6% is found by finding the square root of 61.8%. Some traders prefer to use the ratio of 76.4% which is found by subtracting 0.236 from 1.00 (1.00 – 0.236 = 0.764).

- In addition to these four ratios, the 0% and 100% retracement levels are also use to mark the start of the retracement and a full retracement of the previous move, and the 50% retracement level is used to mark the mid-point between the swing high and the swing low of the wave. The 50.0% level is not a Fibonacci ratio, per se, but is a point of interest on the charts that the retracement adheres to from time to time.

Using Fibonacci Price Retracements

Fibonacci retracements is based on the idea that markets will retrace a predictable portion of the previous movement before price action resumes in the direction of the larger trend. This is based on the fact that the financial markets do not trend in a straight line. Instead the trend is interrupted by retracements that tend not to exceed the previous wave.

When using Fibonacci retracements, a technical analyst waits for the market to turn and then divides the previous trend movement, or wave, by the Fibonacci retracement ratios, starting from the previous swing points that defined the last wave in the trend. Horizontal lines are then drawn at these levels and are used a possible support levels if the larger trend is an uptrend, or as possible resistance levels if the larger trend is a down trend. These thus become places at which the trader could buy in a larger uptrend or sell in a larger down trend. The most significant levels are usually the 61.8% level and the 38.2% level. The 23.6% level and the 78.6% (or 76.4%) levels are not as significant. In other words, the trader will anticipate that the price action will encounter possible support or resistance when it retraces 23.6%, 38.2%, 50%, 61.8% and 78.6% of the previous movement. As the price action reaches these levels, the trader would be ready to enter a trade, should a swing point form at one of these levels. This would be a sign of the trend resuming. A protective stop order should be in place somewhere on the other side of the swing point in case the price action takes out the swing point.

Multiple Fibonacci retracement studies can also be drawn starting from swing points in a different trend magnitude, i.e., the minor trend, the intermediate trend, and the minor trend. The end points for the different retracements would be the most recent swing point. This creates multiple Fibonacci retracement levels with areas were two or more retracement levels are in close proximity being more significant. It is important that the end point for multiple retracements studies have the same, most recent swing high or swing low as their end points.

Unlike support and resistance lines, old Fibonacci retracement levels do not retain significance once broken. They do not change from support levels to resistance levels once the previous high or low has been broken. When the previous high or low has been broke, new Fibonacci retracements should be drawn once the next swing high or swing low has been formed.

Chart Example

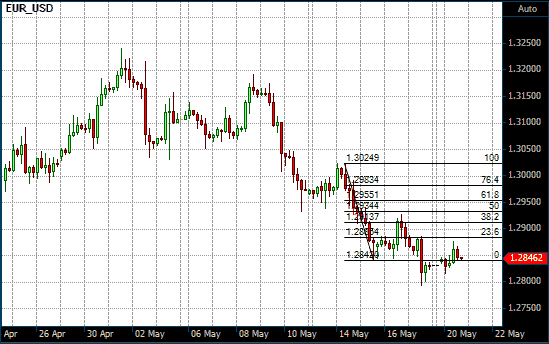

The following is a 4-hour chart of the Euro/USD with Fibonacci Retracements drawn from significant high and lows made on May 14, 2013 and May 15, 2013 respectively. Notice how the subsequent reaction rally met resistance at the 38.2% retracement level before moving lower.

Fibonacci Retracements on a 4 Hour Euro/USD chart

Conclusion

In this lesson we have looked at using the Fibonacci retracement levels to enter a trade. These level range from 0% to 100% and indicates possible levels of support or resistance that could be encountered as the price action retraces from the last swing point. The retracement is not expected to exceed 100% as this will mean the price action would be making a lower low, if the trend is bullish or a higher high, if the trend is bearish. However, it could exceed 100% if the trend is transitioning to a ranging market or to a trend reversal. This is where Fibonacci Price Extensions comes in, though we will discuss Fibonacci Price Extensions later on in this module. In our next lesson we will discuss Fibonacci Price Projections as it can be used to exit a trade.