The Rising and Falling Three Methods Pattern

What is the Three Methods Pattern?

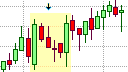

Rising and Falling Three Methods Patterns

The Three Methods candlestick pattern is a trend continuation pattern that is similar to the Mat Holds pattern and is part of Sakata's Five Methods. It can appear in an uptrend or a down trend. In an uptrend it is called the Rising Three Methods pattern and, in a downtrend, it is called the Falling Three Methods pattern. Despite its name, the Three Methods pattern usually consists of at five candlesticks but may be formed by four or more candlesticks. It is similar to the Western Flag or Pennant formations. The Three Methods pattern reflects a market at rest during a rally or a decline and represents a period of congestion or consolidation with market participants possibly taking profit.

The Three Methods Formation

The Three Methods pattern is a continuation pattern and must appear in an existing trend otherwise, it is of no significance. The first candlestick in this pattern must be a relatively large candlestick with a large real body that is supportive of the current trend. The following few candlesticks should be smaller candlesticks that collectively move against the current trend without exceeding the range of the first candlestick. These could be two or more candlesticks, though three is the most common number for these candlesticks. The last candlestick that completes the Three Methods pattern should be another relatively large candlestick with a large real body that is again supportive of the current trend, and exceeds the range of the series of countertrend candlesticks that preceded it. The resulting formation takes the appearance of a series of small countertrend candlesticks that are flanked by two large candlesticks that support the underlying trend. The Three Methods pattern is more reliable if the first and last candlesticks are Marubozu candlesticks with little or no upper and lower shadows.

The Rising Three Methods Pattern

The Rising Three Methods pattern is a bullish continuation pattern that can form during a strong uptrend. It usually consists of five or more candlestick with the first candlestick being a relatively large, bullish candlestick with a large, light-colored real body. This large bullish candlestick is followed by two or more small candlesticks that collectively move against the uptrend. These small candlesticks are usually bearish candlesticks but could include one or two light-colored candlesticks. The important factor is that these smaller candlesticks should not exceed the range of the first candlestick in the pattern. In other words, none of the smaller candlesticks should make a higher high or a lower low than the first candlestick. The last candlestick that completes the Rising Three Methods pattern should open higher than the close of its preceding small candlestick and should be a large candlestick that closes above the close of the first candlestick.

What the Rising Three Methods Pattern tells us

The Rising Three Methods pattern appears during a strong uptrend where the bulls have been firmly in control of the market for a while. This control continues during the formation of the first large, bullish candlestick in the pattern. The appearance of the second candlestick, a small bearish candlestick, suggests that there may be some weakness in the uptrend. This may create some doubt among the bulls and may result in some of them taking profit on the next few candlesticks. After a few sessions the bulls may realize that the bears are weak as they were unable to make a new low. This may encourage fresh bullishness that results in a resumption of the uptrend.

In essence, the Rising Three Methods represents a minor correction during a rally with bulls taking profit rather than the bears showing their strength. This would be the most likely scenario when there is a significant drop in volume on the smaller countertrend candlesticks.

Trading the Rising Three Methods Pattern

As the Rising Three Methods pattern a trend continuation pattern, it provides a trader with the opportunity to trade in the direction of trend. On the close of the last candlestick in the Rising Three Methods pattern a trader, thus, has the opportunity to either enter into a long position or to add to an existing long position by placing a buy order on the open of the candlestick that follows the Rising Three Methods pattern. A protective stop-loss for these trades could be placed just below the lowest low of the last two candlesticks in the pattern. It also provides an opportunity for traders with existing long positions to move their stop-loss closer and place it just below the lowest low of the last two candlesticks in the pattern.

The Rising Three Methods pattern does not provide a profit target for the trade. Instead, a trader could use a trailing stop to exit the long position or wait for a bearish reversal pattern to exit the trade.

As with most trend reversal patterns, the Rising Three Methods pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc.

The Falling Three Methods Pattern

The Falling Three Methods is the bearish counterpart to the Rising Three Methods and can appear in an established downtrend. The first candlestick in this pattern is a dark bearish candlestick with a large real body. The following few candlesticks should be smaller candlesticks that are generally bullish but could include on or two small bearish candlesticks. These smaller candlesticks should not exceed the price range of the first candlestick. The last candlestick that completes the Falling Three Methods should open below the close of its preceding small candlestick and should be a large bearish candlestick that closes lower that the close of the first candlestick.

What the Falling Three Methods Pattern tells us

The Falling Three Methods pattern appears during a strong decline in the market where the bears are still firmly in control as the first candlestick in the pattern is formed. The length of the first candlestick reflects the on-going strength of the bears. However, the appearance of the second candlestick in the pattern suggests that there may be some weakness in the downtrend as the second candlestick is a small bearish candlestick. This may create some doubt among the bears and may result in some of them taking profit during the next few trading sessions. After a few sessions the bears may realize that the bulls are weak as they are struggling to drive the price higher. This may encourage fresh bearishness that results in a resumption of the downtrend.

Trading the Falling Three Methods Pattern

Being a trend continuation pattern, the Falling Three Methods pattern provides a trader with the opportunity to trade in the direction of major trend, which is a downtrend. Therefore, the trader could either enter into a short position or to add to an existing short position on the open of the candlestick that follows the Falling Three Methods pattern. A protective stop-loss could be placed just above the highest high of the last two candlesticks in the pattern. It also provides an opportunity for traders with open short positions to move their stop-loss closer and place it just above the highest high of the last two candlesticks.

Like the Rising Three Methods, the Falling Three Methods pattern does not provide a profit target for the trade. Instead, a trader could use a trailing stop to exit the short position or wait for a bullish reversal pattern to emerge to exit the trade.

The Three Methods Bottom becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc.

As always, disciplined money management should be exercised when trading the market.