The Spinning Top Candlestick Pattern

What is the Spinning Top Pattern?

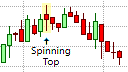

The Spinning Top Pattern

The Spinning Top candlestick pattern is a single candlestick pattern that is similar in appearance to the Evening Star and the Morning Star patterns, except that it consists of a single candlestick and need not gap away from the previous candlestick. In other words, the Spinning Top takes the form of a Star if it follows a relatively large candlestick with a large real body and gaps away from that candlestick, in the direction of the trend. The Spinning Top itself indicates a period of indecision and warns that the current trend may be weakening and may be coming to an end, or the trend may be consolidating or correcting before continuing.

On its own, the Spinning Top may be a continuation pattern with the market catching its breath momentarily while it consolidates or corrects before continuing with the trend. But, when analyzed in the context of the preceding candlesticks, it may become, or form part of a trend reversal pattern.

As already mentioned, it could be part of the Morning Star and Evening Star patterns, as well as the Tweezer Top and Tweezer Bottom patterns; the Engulfing pattern, if it is the first candlestick that is engulfed by the real body of the candlestick that follows it; the Harami pattern, if it is the second candlestick that is enclosed within the real body of the previous candlestick; and the Homing Pigeon pattern.

The Spinning Top Formation

The Spinning Top is a single candlestick pattern with a relatively small real body and an upper and lower shadow that is longer than the length of its real body. This gives it the appearance of a spinning top. In other words, the open and the close of the Spinning Top are near to each other, which renders the color of the Spinning Top's real body as not of significance.

What the Spinning Top Pattern tells us

The Spinning Top pattern, with its short real body is a neutral candlestick that indicates that the market is momentarily indecisive or uncertain. Neither the bulls not the bears were able to move the market significantly in their favor during the session. In a strong trending market, it may indicate a possible transition to a trend reversal but in a weaker trend it may be a continuation pattern with the market either consolidating or correcting before continuing in the direction of the prevailing trend. Therefore, the Spinning Top should be analyzed in relation with the other candlesticks that preceded it.

Trading the Spinning Top Pattern

The Spinning Top can be a reversal pattern when it appears in an extended or very strong trend where it could signal the possible end of that trend and a possible reversal. In a weaker trend it may indicate that the market is consolidating or correcting before continuing with the trend. It is therefore important to obtain confirmation before acting upon the Spinning Top pattern. Confirmation is achieved when the candlestick that follows the Spinning Top closes higher or lower than the Spinning Top.

The Spinning Top could also be analyzed in conjunction with the candlesticks that preceded it and the price chart in general. If it appears at a resistance area in a downtrend, or a support area in an uptrend, the Spinning Top becomes more significant and the support or resistance may either hold or fail. The Spinning Top may also form part of other candlestick patterns, such as the Morning Star and the Evening Star patterns, the Tweezer Top and Tweezer Bottom patterns, the bullish or bearish Engulfing pattern, the Harami pattern, and the Homing Pigeon pattern.

Trading the Bullish Spinning Top Pattern

The bullish Spinning Top pattern potential bullish trend reversal pattern that warns of weakness in the downtrend and possible transition to a uptrend. Once confirmation of the bullish Spinning Top pattern has been acquired, a trader with open short positions would look to cover their shorts and go long. Entry would be on the open of the candlestick following the candlestick that provided confirmation of the pattern. A protective stop-loss order should be used to limit the risk of the pattern failing and could be placed just below the low of the Spinning Top as a break below the bullish Spinning Top would invalidate the reversal signal. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential support area represented by up gap above the Spinning Top before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The bullish Spinning Top pattern does not provide a clear profit target but previous levels of support or previous area of consolidation could be used as an initial price target. A trader could also implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop.

Trading the Bearish Spinning Top Pattern

The bearish Spinning Top pattern potential bearish trend reversal pattern that warns of weakness in the uptrend. Once the bearish Spinning Top pattern has been confirmed by the next candlestick closing below the Spinning Top, a trader with open long positions would look to close their longs and go short. Entry would be on the open of the candlestick following the candlestick that provided confirmation of the pattern. A protective stop-loss order should be used to limit the risk of the pattern failing and could be placed just above the high of the Spinning Top as a break above the bearish Spinning Top would invalidate the reversal signal. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented by up gap below the Spinning Top before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The bearish Spinning Top pattern also does not provide a clear profit target but previous levels of support or previous area of consolidation could be used as an initial price target. A trader could also implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.