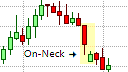

The On-Neck Candlestick Pattern

What is the On-Neck Pattern?

The On-Neck Pattern

The On-Neck candlestick pattern is a rare variation of the In-Neck pattern. Like the In-Neck pattern, the On-Neck pattern is a double candlestick pattern that could appear in a downtrend and is a bearish trend continuation pattern. It indicates that the current downtrend could be expected to continue and must, therefore, appear in an existing downtrend for the pattern to be of any significance.

The On-Neck pattern is also related to the Trusting Line pattern is also a double candlestick patterns that has the same general formation but differ by the extent that the second candlestick penetrates the real body of the previous candlestick.

Another similar pattern is the Piercing Line pattern, though the Piercing Line pattern in a downtrend is considered a bullish trend reversal pattern because of the extent to which the second candlestick penetrates into the real body of the previous candlestick

The On-Neck Formation

The On-Neck pattern consists of two candlesticks with alternating colors. The first candlestick must be supportive of the current downtrend. Thus, it must be a black or dark-colored candlestick with a large real body. The second candlestick then gaps down and well away from the real body of the previous candlestick to open below the low of the previous candlestick. This candlestick then reverses direction, becoming a bullish candlestick that closes at or very near the low of the previous candlestick. If it does close at, or very near the close of the previous candlestick, then the formation becomes an In-Neck pattern.

What the On-Neck Pattern tells us

The first candlestick in the On-Neck pattern is strong, bearish candlestick that indicates that the on-going sell off is still going strong. The second candlestick then gap down at the open to below the real body the previous candlestick, reinforcing the notion that the downtrend is still strong. However, this candlestick then reverses direction and closes higher than its open but well short of the real body of the first candlestick. This could indicate weakness in the current down trend as the bearishness that preceded the second candlestick has dissipated and been replace by indecision in the market. However, the small size of the second candlestick's real body, and its failure to penetrate the real body of the previous candlestick suggests that this might be a short period of correction. In which case, the market could be expected to resume its decline.

Trading the On-Neck Pattern

The On-Neck pattern is a bearish trend continuation pattern and, as with other trend continuation patterns, it represents an opportunity for the trader to enter a short position, or to add to an existing short position, once confirmation has been provided. Confirmation would be in the form of a close below the low of the second candlestick in the pattern. When entering a new position, a protective stop-loss should be placed just above the high of the first candlestick as a price movement above the pattern indicates that the correction might be extended or that the weakness in the downtrend may be deeper rooted. The On-Neck pattern also represents an opportunity for a trader that has an open (existing) short position to move their protective stop-loss to just above the high of the first candlestick.

The On-Neck pattern does not provide a clear profit target but previous levels of support or previous area of consolidation could be used as an initial price target. A trader could also implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most other trend continuation patterns, the On-Neck pattern becomes more reliable if it at an upper trendline or a resistance line on the price chart, where it could indicate that these levels have held. Traders can use the On-Neck pattern in conjunction with an oscillating indicator, such as the RSI.