The Ladded Bottom Pattern

What is the Ladded Bottom Pattern?

The Ladded Bottom Pattern

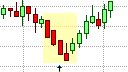

The Ladded Bottom pattern is a rare bullish trend reversal pattern that can appear in an established downtrend. It warns of growing weakness in the down trend and a possible transition to a future uptrend. It is similar to the Concealing Baby Swallow pattern, and similar in appearance to the bearish Three Black Crows pattern, though the Ladded Bottom pattern consists of five candlesticks and appears in a downtrend.

The Ladded Bottom Formation

The Ladded Bottom pattern consists of five candlesticks of which the first three candlesticks take the same form of the Three Black Crows pattern, but in a downtrend. As in the bearish Three Black Crows pattern, each of these candlesticks should be relatively long, bearish Marubozu candlesticks that close at or near the low price for that trading session or period and have little or no lower shadows. Each of these candlesticks marks a strong, steady decline in the price of the underlying security and makes consecutively lower closing prices. They could have overlapping real bodies, i.e., each successive candlestick opens within the real body of the previous candlestick, though this is not an absolute requirement.

The fourth candlestick in the Ladded Bottom pattern is also a bearish candlestick but it has a short real body and a long upper shadow, which marks a weakening in the trend. This is followed by a bullish fifth candlestick that is light in color that opens above the real body of the fourth candlestick and closes even higher. These last two candlesticks have bullish implications.

What the Ladded Bottom Pattern tells us

As the first three candlesticks in the Ladded Bottom pattern are Marubozu candlesticks, they appear to support the current downtrend and imply that the downtrend is still going strong. However, should the three candlesticks have increasing overlap, and be increasingly shorter candlesticks, they also indicate that the underlying downtrend is diminishing in strength. This is why it is important to understand candlesticks in the context of the other candlesticks that preceded it.

Even if the first three candlesticks do not have increasingly greater overlap or increasingly shorter real bodies, the fourth candlestick in the Ladded Bottom pattern surely does as it is one of the requirements for the Ladded Bottom. The fourth candlestick, though still bearish, shows a weakness in the downtrend. This is portrayed by its relatively long upper shadow and its relatively short real body. The fourth candlestick is the initial signal of a possible transition to an uptrend. The possibility of a transition to an uptrend increases on the appearance of the fifth candlestick that is a bullish candlestick.

Trading the Ladded Bottom Pattern

The Ladded Bottom pattern is a bullish trend reversal pattern warns of increasing weakness in an existing downtrend and a possible transition to an uptrend. Trader would, thus, be looking to close any open short positions and go long, but the formation of the Ladded Bottom pattern should be completed first. Traders that are currently holding short positions would then be looking to cover their short positions on the open of the next candlestick. Traders would also be looking to place buy orders but should first wait for confirmation of the reversal. This confirmation would be in the form of a candlestick closing above the real body of the third candlestick in the Ladded Bottom formation. A protective stop loss could be placed at the low of the pattern, which would usually be the low of the last candlestick in the pattern. A price break below this level would negate the pattern making it a logical place to put a stop loss. If the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible retracement back towards the low of Ladded Bottom pattern. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a retracement will take place.

The Ladded Bottom pattern, like most candlestick patterns, does not provide a profit target for the trade. Instead, a trader could implement a profit target based on a defined risk/reward ratio, a measured move, or use a trailing stop to exit the long position. Alternatively, some other trading mechanism could be used to exit the trade. This could be a Fibonacci retracement level or the appearance of a bearish candlestick formation.

As with most trend reversal patterns, the Ladded Bottom pattern becomes more reliable when it appears in the vicinity of a lower trendline, a pivot point, or support line, etc. Furthermore, traders can use the Ladded Bottom pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be oversold.