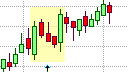

Candlestick Continuation Patterns

Candlestick Continuation Patterns

Continuation patterns indicate that the market is momentarily resting as it resets to overcome oversold or overbought conditions. These patterns are formed when the price action enters a consolidation or correction phase during a trend. During the consolidation or correction phase the market sentiment may appear to have changed, but this may be natural phenomena of a trend that has become a little over saturated. Once the over saturated conditions have been overcome, the trend should resume. During the consolidation or correction phase traders may opt to close their position and take profit rather than initiate trades against the prevailing trend. Hence, the consolidation or correction is too weak to cause a reversal of the trend and the continuation of the preceding trend is much more probable.

There are far fewer continuation patterns than trend reversal patterns when it comes to candlestick patterns. Also, candlestick continuation patterns tend to consist of more candlesticks than trend reversal candlestick patterns as they are usually formed during a consolidation or correction phase when the price moves, without great conviction, against the prevailing trend. For this reason, there are no single candlestick patterns that can be classified as continuation patterns. While there are a few continuation patterns that consist of two candlesticks, most candlestick continuation patterns consist of more than three candlesticks.

As with trend reversal patterns, a continuation pattern must appear in a well-established trend, be it an uptrend or a downtrend. Furthermore, when the consolidation or correction phase that forms the continuation pattern that appears near or on a support area in an uptrend, or near a resistance area in a down trend, the continuation pattern has a greater probability of success.

Candlestick continuation patterns can be bullish, when it appears in an uptrend, or bearish, when it appears in an established downtrend. In either event, a candlestick continuation pattern represents an opportunity to enter into a trade in the direction of the prevailing trend as it indicates that the continuation of the existing trend is far more likely than a reversal of that trend.

Double candlestick patterns that are classified as continuation patterns include:

The In-Neck, On-Neck, and Thrusting Line patterns are all underdeveloped variations of the Piercing Line pattern, although the Piercing Line pattern is classified as a trend reversal pattern.

Candlestick continuation patterns that consist of three or more candlesticks include:

There are also several continuation candlestick patterns that contain gaps or windows. These include: