The Advance Block Candlestick Pattern

What is the Advance Block Pattern?

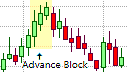

The Advance Block

The Advance Block candlestick pattern is a moderate bearish trend reversal pattern that can form during an uptrend. It is a three-candlestick pattern that is a variation of the Stalled pattern and is similar in appearance to the bullish Three Advancing White Soldiers pattern that can form during a downtrend.

The Advance Block Formation

The Advance Block pattern consists of three successive candlesticks that, while they are light in color and are thus bullish, indicate a weakening of the underlying trend. The first candlestick in the Advance Block formation should be a large bullish candlestick with little or no upper shadow. This is followed by a second bullish candlestick that opens within the real body of the first candlestick but closes higher than the first candlestick. The second candlestick's real body must be smaller than the real body of the first candlestick while its upper shadow can be longer than that of the first candlestick. The third candlestick in the Advance Block pattern is also a bullish candlestick that also opens within the real body of the second (preceding) candlestick and closes higher than the second candlestick. The third candlestick should have an even smaller real body than its predecessor and possibly an even longer upper shadow. In short, the Advance Block pattern is a three-candlestick formation that consists of three bullish candlesticks with each successive candlestick opening within the real body of the previous candlestick and making a higher high but each having a successively shorter real body, and possibly a longer upper wick or shadow.

What the Advance Block Pattern tells us

While the Advance Block pattern appears to support the current uptrend, it also indicates that the current trend is weakening. This can be seen in the successively shorter real bodies of each candlestick that, together with the longer shadows on the last two candlesticks, indicate an increasing weakness in the underlying uptrend. This points to a potential end to the rally and the possible emergence of a downtrend, though it can also be the start of a short consolidation phase.

Trading the Advance Block

The Advance Block pattern is a moderate reversal pattern and does not necessarily indicate the emergence of a downtrend as the candlesticks that form the pattern are still bullish in nature. Therefore, this pattern should be used more to protect a long position rather than entering a short position. Traders with open long positions could either exit their positions on the opening of the next candlestick or wait for confirmation of the pattern before exiting their positions. Traders would also be anticipating the emergence of a downtrend and will be looking for bearish confirmation of the Advance Block pattern. This confirmation could be in the form of a subsequent candlestick penetrating beyond the second candlestick's real body as this increases the possibility of a bearish trend reversal. Once confirmation has been acquired, the trader could open a short position either just below the midpoint of the second candlestick's real body, or on the open of the next candlestick.

Taking a short position would mean trading against the current trend; therefore, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop could be placed just above the highest high of the candlestick in this formation as a price break above this level would negate the pattern. However, if the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented by the high of the pattern before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur. Remember that confirmation of the pattern must first be obtained before placing a sell order.

As with most candlestick patterns, the Advance Block pattern does not provide a clear profit target. Instead, a trader could implement a profit target based on a defined risk/reward ratio or some other trading mechanism can be used to exit the trade, such as a key Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most trend reversal patterns, the Advance Block pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc. An Advance Block pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the Advance Block pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the Advance Block pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.

Remember that disciplined money management should always be exercised when trading the market.