Motive Waves

Welcome to our second lesson on Elliott Wave Theory. In this lesson we will look at Motive Waves and the various types of motive waves. We will also look at the characteristics of motive waves and the Fibonacci Ratios of the subwaves of a motive wave.

What are Motive Waves?

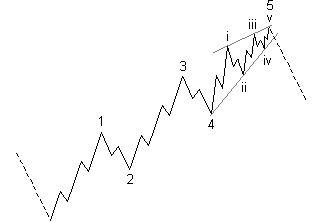

The price action in a motive wave moves in the direction of the trend of the larger wave of one higher degree, progressing the larger trend. A motive wave always consists of five subordinate waves or subwaves, though one or two of the motive subwaves can be extended. In a larger motive wave, the subordinate waves 1, 3, and 5 are motive subwaves as they progress the trend of the main wave. The main wave, in relation to the subordinate waves, is the larger trend. In a corrective wave, subordinate waves A and C are also motive subwaves as they also progress the trend of the main wave. In general, motive waves provide better trading opportunities as they are often easier to identify and label than corrective waves, and are also often accompanied stronger and faster price movements. This might explain why motive waves are often referred to as impulse waves; though not all motive waves are impulse waves.

Types of Motive Waves

There are two types of motive waves: impulse waves and diagonals.

- Impulse Waves are the most common type of motive waves and have a strong price movement. In an impulse wave, subwave 4 (Wave 4 of a lesser degree) should not retrace into the price area of subwave 1. One or more of the subordinate waves of an impulse wave often contains extensions, making it an elongated impulse wave with exaggerated subdivisions. Wave 3 is always an impulse wave.

- Diagonals are far less common types of motive waves and take the form of a wedge pattern that also consists of five subordinate waves. Diagonals usually have shallow price movements and can be classified as leading diagonals or as ending diagonals.

An Ending Diagonal

- Leading Diagonals occasionally occur in the Wave 1 position where the subordinate Wave 4 of Wave 1 retraces into the price area of subordinate Wave 1 of Wave 1. The five subordinate waves of a leading diagonal usually consist of three subwaves, creating a 3-3-3-3-3 wave count. On rare occasions, subordinate waves 1, 3 and 5 consists of 5 subwaves, creating a 5-3-5-3-5 wave count. Leading diagonals can also take the form of an expanding triangle, or a megaphone pattern, though these tend to appears at the start of a bearish price decline.

- Ending Diagonals occasionally occur in the Wave 5 where subwave 4 (Wave 4 of a lesser degree) again retraces into the price area of subwave 1. Ending Diagonals mark the probable end of the larger trend movement and indicates exhaustion of that trend and the start of a strong move in the opposite direction.

Motive Wave Characteristics

- Wave 1 is part of a basing process for the next price movement in the direction of the larger trend. It is the hardest to identify as it is often seen as a correction against the dominant trend rather than the start of a new trend. Wave 1 can be either an impulse wave with a strong price movement, or a leading diagonal with a shallower price movement. It is usually the shortest and weakest of the motive waves and is often characterized by a cautious market sentiment.

- Wave 2 re-enforces the view that the preceding A-B-C correction was the dominant trend when it starts to retrace Wave 1. This explains why Wave 2 is often a sharp, deep retracement of Wave 1 and usually ends at the 61.8% or 78.6% Fibonacci Retracement level. A Wave 2 retracement should not retrace beyond the start of Wave 1, which is also the end of Wave C of the corrective phase. Should Wave 2 retrace beyond the start of Wave 1 (and the end of Wave C) then it is still part of the corrective phase and what was thought to be Wave 1 is actually an intermediate wave (Wave X) that connects multiple corrective waves. Intermediate waves are discussed in the next lesson on Corrective Waves.

- Wave 3 is usually the most powerful wave as most participants in the market have now realized which trend is in progress. With more participants, Wave 3 often has the most momentum and travels much further than Wave 1. For this reason, Wave 3 is often, but not always, the largest of the motive waves, i.e., it is often the largest of Wave 1, Wave 3, and Wave 5. Wave 3 cannot be the shortest of Wave 1, Wave 3, and Wave 5. Wave 3 is also always an impulse wave and is never a diagonal.

- Wave 4 is a correction of Wave 3 that fails to overcome the euphoria that powered Wave 3 but it does drain most of the euphoria in what is often a drawn out, shallow retracement. A Wave 4 retracement often lasts longer, in terms of time, than a Wave 2 retracement although Wave 4 often retraces less than Wave 2, and usually ends at the 38.2%, 50.0% or 78.6% Fibonacci Retracement level.

- Wave 5 is the final push but usually does not have the same level of commitment as Wave 3. It thus often lacks the momentum found in Wave 3 and may even fail to move beyond the end of Wave 3. When Wave 5 fails to move beyond the end of Wave 3, it is referred to as truncation. Wave 5 can also be an ending diagonal or it can have extensions. Fifth wave extensions, fifth wave truncations and ending diagonals all imply that the current trend has become exhausted and warns that a probable trend reversal will soon follow.

Motive Wave Extensions

Wave extensions in Motive Waves apply to impulse waves rather than diagonal triangles. Most impulse waves contain what Ralph Elliott referred to as extensions that elongate an pulse wave. The result in a wave that has additional subordinate waves with a total wave count of nine rather than the normal five. The size of the subordinate waves can be used to ascertain which of the three motive waves is the extended wave as the subordinate waves of an extended impulse wave will be of a similar size. Though, an impulse wave with a 5 wave count and an impulse wave with a 9 wave count has the same technical significance in Elliott Wave Theory.

Only one or two of the motive waves can be elongated; not all three. Wave 3 is usually the most commonly extended wave, except in Commodities that are in a major bull market where a Wave 5 extension is more common. A Wave 5 extension is often referred to as an extended fifth.

The correction following an extended fifth is often a sharp correction that finds support at the level of the low of Wave 2 of the extension.

Motive Wave and Fibonacci Ratios

The proportionality of subordinate waves in an Elliott Wave pattern are often related to Fibonacci Ratios. These are as follows:

- Wave 2 usually retraces to the 61.8% or 78.6% Fibonacci Retracement level of Wave 1. In some instances, it could also retrace to the 50.0%, 61.8%, 78.6%, or 85.4% Fibonacci Retracement level of Wave 1.

- Wave 3 is usually the longest motive wave and usually extends to the 161.8% Fibonacci Projection level of Wave 1.

- Wave 4 usually retraces to the 14.6%, 23.6%, or 38.2% Fibonacci Retracement level of Wave 3.

- Wave 5 is more varied and can be measure in three different ways:

- Wave 5 is usually equal in length to Wave 1, making it a 100.0% Fibonacci Projection level of Wave 1. In our discussion of Elliott Waves, length is always a measure of price movement. It is not a measure of time.

- Wave 5 can retrace to between the 123.6% and 161.8% Fibonacci Retracement level of Wave 4.

- Wave 5 can be a 61.8% Fibonacci Projection level from the start of Wave 1 to the end of Wave 3.